The Skeptics

A Tribute to Bold Assertions

“We propose a global and morally mandatory heuristic that anyone involved in an action which can possibly generate harm for others, even probabilistically, should be required to be exposed to some damage, regardless of context.”

N.N. Taleb & C. Sandis, “The Skin in the Game Heuristic for Protection Against Tail Events”

Submit a link via GitHub

Source: Satoshi Nakamoto Institute

Niels van der Linden - April 22, 2011 ($0.77)

Amateur economist, VforVoluntary.com

Don’t Buy Bitcoins (YouTube)

Tim Worstall - June 20, 2011 ($17.26)

Journalist

So, That’s the End of Bitcoin Then (Forbes)

It’s difficult to see what the currency has going for it.

Peter Schiff - June 20, 2011 ($17.50)

CEO, Euro Pacific Capital, Inc.

Peter Schiff Radio Show with Bitcoin (YouTube)

What [bitcoins] lack is their own fundamental intrinsic value. You can’t do anything with a bitcoin, other than trade it for something you want. So, intrinsically, the bitcoin itself has no value. It only has value as a medium of exchange so long as people are willing to accept it.

Adrian Covert - August 09, 2011 ($8.02)

Journalist

The Bitcoin Is Dying (Gizmodo Australia)

The lulz were abundant. But frankly, it’s time for you to go. Farewell.

Michael Calore - December 24, 2012 ($13.27)

Journalist

Wired, Tired, Expired for 2012: From Stellar to Suck (Wired)

Then came the malware, the black market, the legal ambiguities and The Man. Today, you can’t even use it to buy Facebook stock

Patrik Korda - March 05, 2013 ($34.00)

Amateur trader

Bitcoin Bubble 2.0 (Seeking Alpha)

Thus, we have an answer before us: bitcoins are fiduciary media, or more specifically token money. From a monetary standpoint, as devised and formulated by Ludwig von Mises, they are on a par with the stuff you find at Chuck E. Cheese’s.

Heidi Moore - April 03, 2013 ($115.09)

Finance and Economics Editor, The Guardian US

Confused about Bitcoin? It’s ‘the Harlem Shake of currency’ (The Guardian US)

Of course, in a rational world, none of that will be written, except perhaps as satire. Bitcoin’s crash is less of a currency crisis than an opportune moment for internet wisecracks.

Kurt Eichenwald - April 09, 2013 ($239.98)

Contributing editor, Vanity Fair

The Logic Problems That Will Eventually Pop the Bitcoin Bubble (Vanity Fair)

So, anyone out there buying Bitcoins at ridiculously inflated prices, please recognize the risk you are taking. You will likely lose everything.

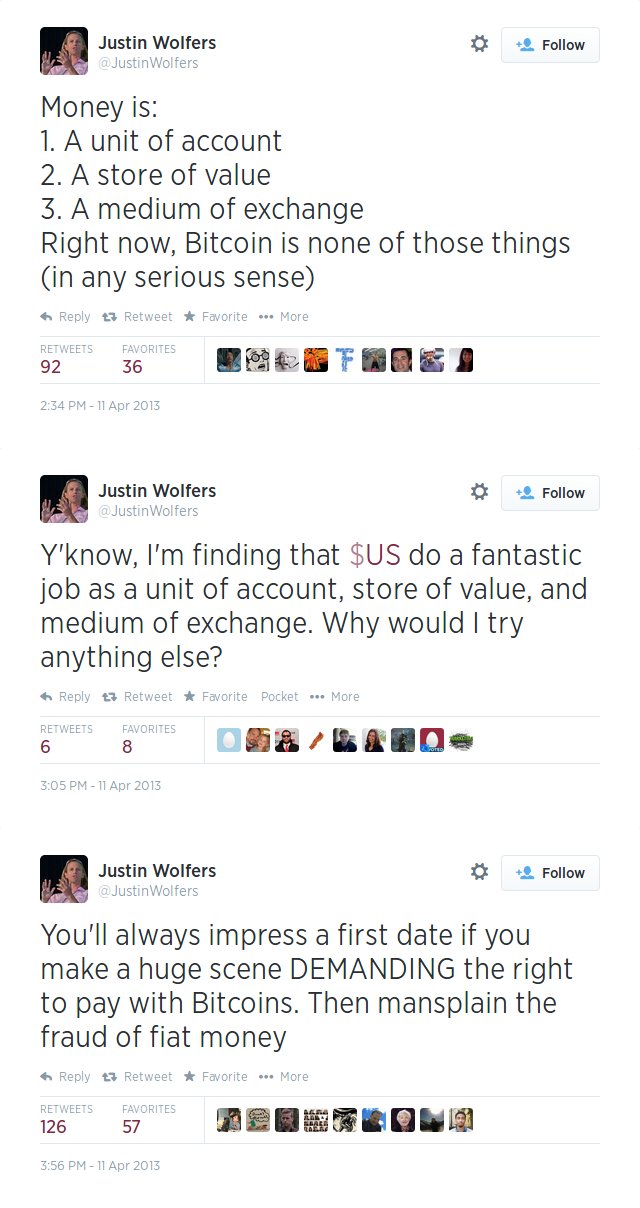

Justin Wolfers - April 11, 2013 ($84.46)

Economist, Brookings Institution

- https://twitter.com/justinwolfers/status/322432361155424259

- https://twitter.com/justinwolfers/status/322440315397107712

- https://twitter.com/justinwolfers/status/322453007168045057

Robert McMillan - May 10, 2013 ($115.48)

Journalist

Watch Wired Get Rich Quick With Our Sleek Bitcoin Miner (Wired)

But in the end, the answer was obvious. The world’s most popular digital currency really is nothing more than an abstraction. So we’re destroying the private key used by our Bitcon wallet.

Ian Bremmer - May 14, 2013 ($115.01)

Founder and President, Eurasia Group

Strategist predicts end of Bitcoin (CNN Money)

“I would be very surprised if Bitcoin is still around in 10 years,” said Bremmer, the founder and CEO of Eurasia Group, the world’s largest risk consulting firm. He thinks that bigger players will enter the field and improve upon Bitcoin’s weaknesses.

David S. Evans - October 16, 2013 ($137.54)

Chairman of the Global Economics Group

Bitcoin is a Remarkable Innovation, Here’s Why It Will Fail (Pymnts.com)

I think there are two realistic directions the bitcoin ecosystem could go in. First, it could just implode and disappear if governments decide that virtual currencies cause too much harm and are too hard to regulate. Long-term investments in bitcoin would then go up in smoke. Second, it could continue as a virtual currency that is only used on the dark web with exchanges that are run by people willing to break the laws. The value of bitcoin would decline to whatever the illegal sector could support; regular investors wouldn’t be able to get their value from bitcoin unless they cashed it in with someone who wanted to do bad things.

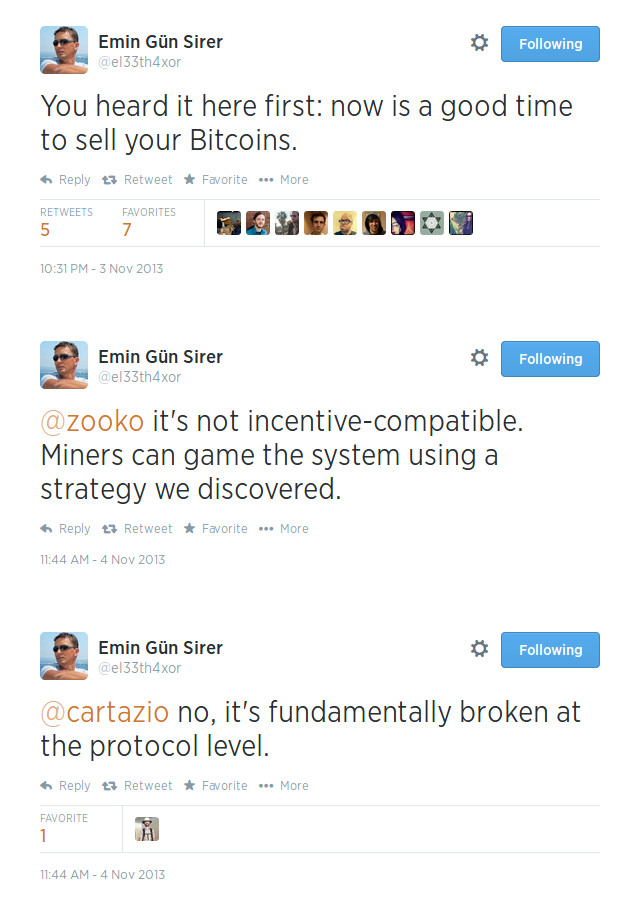

Emin Gün Sirer - November 03, 2013 ($214.13)

Professor, Cornell University

- https://twitter.com/el33th4xor/status/397219415025934336

- https://twitter.com/el33th4xor/status/397419061019443200

- https://twitter.com/el33th4xor/status/397419072658604032

Joseph Weisenthal - November 06, 2013 ($264.61)

Executive Editor, Business Insider

Bitcoin Is A Joke (Business Insider)

Bitcoin? Nada. There’s nothing keeping it being a thing. If people lose faith in it, it’s over. Bitcoin is fiat currency in the most literal sense of the word.

Kevin Rose - November 08, 2013 ($330.01)

Co-founder, Digg

Matthew O’Brien - November 21, 2013 ($589.24)

Journalist

Bitcoin Is the Segway of Currency (The Atlantic)

In other words, Bitcoin is a Ponzi scheme libertarians use to make money off each other—because gold wasn’t enough of one for them.

Gary North - November 29, 2013 ($1065.36)

Economist

Bitcoins: The Second Biggest Ponzi Scheme in History (Gary North’s Specific Answers)

Bitcoins will never achieve this. It is a mania going up. It will be a mania coming down. It will not increase the division of labor, because people will recognize it as having been a Ponzi scheme, and they will not again buy it. They will not use it in exchange. Companies will not sell goods and services based on Bitcoins. Bitcoins have to have stable purchasing power if they are to serve as money, and they will never, ever achieve stable purchasing power.

Matthew Yglesias - December 02, 2013 ($1000.49)

Executive Editor, Vox

Why I Haven’t Changed My Mind About Bitcoin (Slate)

My primary interest in Bitcoin is that I think it’s a great platform for making jokes.

Mark T. Williams - December 05, 2013 ($1083.40)

Finance Professor, Boston University

Beware of Bitcoin (Cognoscenti from WBUR Boston NPR)

Once sellers outnumber buyers, prices will eventually drop below $10, erasing all gains. This price collapse will occur by the first half of 2014.

Alex Payne - December 18, 2013 ($527.76)

Developer and Angel Investor

Bitcoin, Magical Thinking, and Political Ideology (al3x.net)

Bitcoin represents more of the same short-sighted hypercapitalism that got us into this mess, minus the accountability.

Charlie Stross - December 18, 2013 ($527.76)

Author

Why I want Bitcoin to die in a fire (Charlie’s Diary)

TL:DR; the current banking industry and late-period capitalism may suck, but replacing it with Bitcoin would be like swapping out a hangnail for Fournier’s gangrene.

Edward Hadas - December 18, 2013 ($527.76)

Economics Editor, Reuters

Bitcoin Mania Heads Into the Endgame (NY Times Dealbook)

The electronic pseudocurrency has had a good run. Ideologues, speculators and scammers enjoyed the fun while it lasted. But now that the authorities are taking notice, the price has much further to fall.

Brad DeLong - December 28, 2013 ($717.51)

Professor of Economics, U.C. Berkeley

Watching Bitcoin, Dogecoin, Etc… (The Equitablog)

You can either work doing something useful, or you can set up a botnet to mine BitCoins, or you can fork the code behind BitCoin and set up your own slightly-tweaked virtual cryptographic money network. Setting up a new, alternative network is really cheap. Thus unless BitCoin going can somehow successfully differentiate itself from the latecomers who are about to emerge, the money supply of BitCoin-like things is infinite because the cost of production of them is infinitesimal.

Paul Krugman - December 28, 2013 ($717.51)

Nobel Prize-winning Economist

Bitcoin is Evil (The New York Times)

So far almost all of the Bitcoin discussion has been positive economics — can this actually work? And I have to say that I’m still deeply unconvinced. To be successful, money must be both a medium of exchange and a reasonably stable store of value. And it remains completely unclear why BitCoin should be a stable store of value.

Lisa Kramer - January 15, 2014 ($830.47)

“Serious Economist”

Bursting the bitcoin bubble (The Globe and Mail)

As a Serious Economist, I had been happily ignoring the recent bitcoin frenzy, safe in the smug knowledge shared by all Serious Economists that the surge in bitcoin value is a bubble that will soon pop.

Jamie Dimon - January 23, 2014 ($811.40)

President & CEO, JPMorgan Chase

Dimon Disses Bitcoin, and Bitcoiners Diss Back (WSJ MoneyBeat)

“It’s a terrible store of value,” Mr. Dimon said in an interview with CNBC. “It could be replicated over and over.”

Paul Singer - January 29, 2014 ($794.65)

CEO, Elliott Management Corporation

Paul Singer: Bitcoin over gold? Are you crazy?! (CNBC)

There is no more reason to believe that bitcoin will stand the test of time than that governments will protect the value of government-created money, although bitcoin is newer and we always look at babies with hope.

Robert J. Shiller - March 01, 2014 ($560.18)

Nobel Prize-winning Economist

In Search of a Stable Electronic Currency (The New York Times)

The Bitcoin phenomenon seems to fit the basic definition of a speculative bubble — that is, a special kind of fad, a mania for holding an asset in expectation of its appreciation.

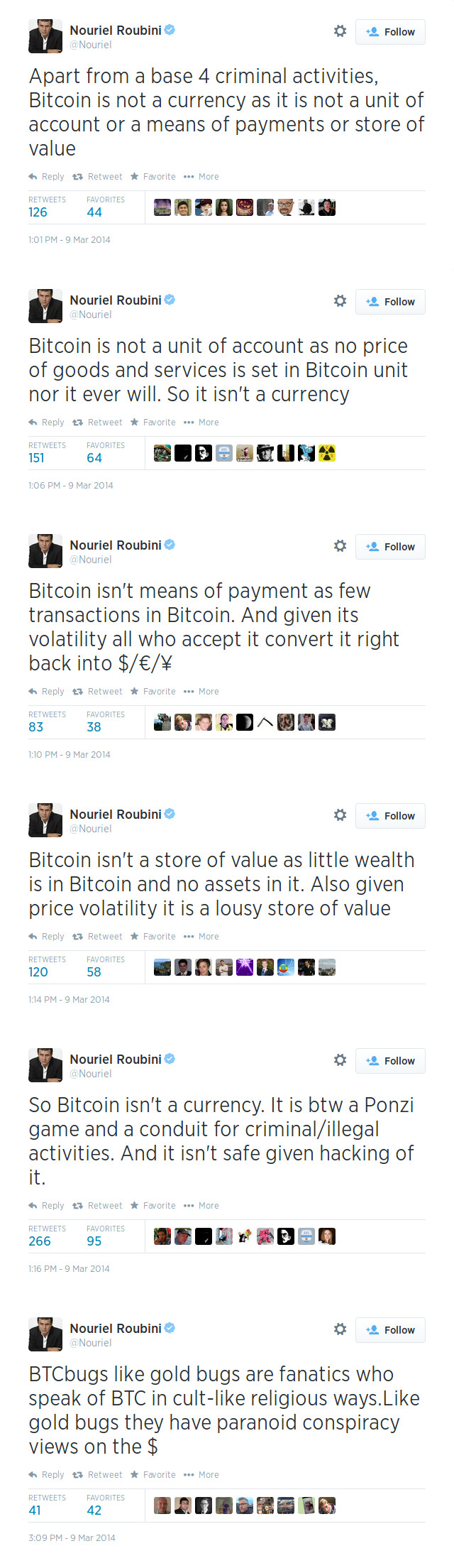

Nouriel Roubini - March 09, 2014 ($637.38)

Professor of Economics, New York University

- https://twitter.com/Nouriel/statuses/442721938054868992

- https://twitter.com/Nouriel/statuses/442723134693969920

- https://twitter.com/Nouriel/statuses/442724222239277057

- https://twitter.com/Nouriel/statuses/442725037289005056

- https://twitter.com/Nouriel/statuses/442725510423248897

- https://twitter.com/Nouriel/statuses/442754188192538624

Warren Buffett - March 14, 2014 ($634.10)

Chairman & CEO, Berkshire Hathaway

Buffett: ‘Stay Away’ From Bitcoin (WSJ MoneyBeat)

“Stay away from it,” he said, according to a transcript. “It’s a mirage basically.”

Anthony Watson & Halsey Minor - October 14, 2015 ($254.74)

CEO and Founder & Chairman, Uphold (formerly Bitreserve), respectively

This bitcoin startup is changing its name and moving away from bitcoin (Fortune)

Watson sounds even more negative on bitcoin. “I’ll be surprised if bitcoin is here in five years,” he has told Fortune. “The value of bitcoin isn’t the currency, but the technology. I think once the world becomes more accustomed and attuned to the platform of bitcoin, the noise will go away, and the currency will go away too.

[…]

Minor, too, predicts that bitcoin as a currency “will get destroyed.” He likens the coin’s current market cap—about $3.7 billion—to “an accounting mistake or rounding error that Bank of America makes.”

Mike Hearn - January 14, 2016 ($429.24)

Lead Platform Engineer, R3CV

The resolution of the Bitcoin experiment (Medium)

But despite knowing that Bitcoin could fail all along, the now inescapable conclusion that it has failed still saddens me greatly. The fundamentals are broken and whatever happens to the price in the short term, the long term trend should probably be downwards. I will no longer be taking part in Bitcoin development and have sold all my coins.

Vivek Wadhwa - January 19, 2016 ($385.51)

Contributor, The Washington Post; Tryhard

R.I.P., Bitcoin. It’s time to move on. (The Washington Post)

Bitcoin did have great potential, but it is damaged beyond repair. A replacement is badly needed.

Jeremy Allaire - November 17, 2016 ($744.86)

CEO, Circle

Circle CEO Allaire: It’s Highly Unlikely We’ll Be Using Bitcoin in 5 or 10 Years (Coin Jounral)

“Our view is that we’re still in the really early stages of the technology and its development,” said Allaire. “It’s highly unlikely that any of us will be using Bitcoin in five or ten years. In the same way that — how many of us use NCSA Mosaic or Netscape Navigator?”

Dan McCrum - January 03, 2017 ($1034.34)

Editor, Financial Times

Bitcoin passes $1,000 but only number that matters is zero (Financial Times)

As a phenomenon bitcoin has all the attributes of a pyramid scheme, requiring a constant influx of converts to push up the price, based on the promise of its use by future converts. So the ultimate value for bitcoin will be the same as all pyramid schemes: zero.